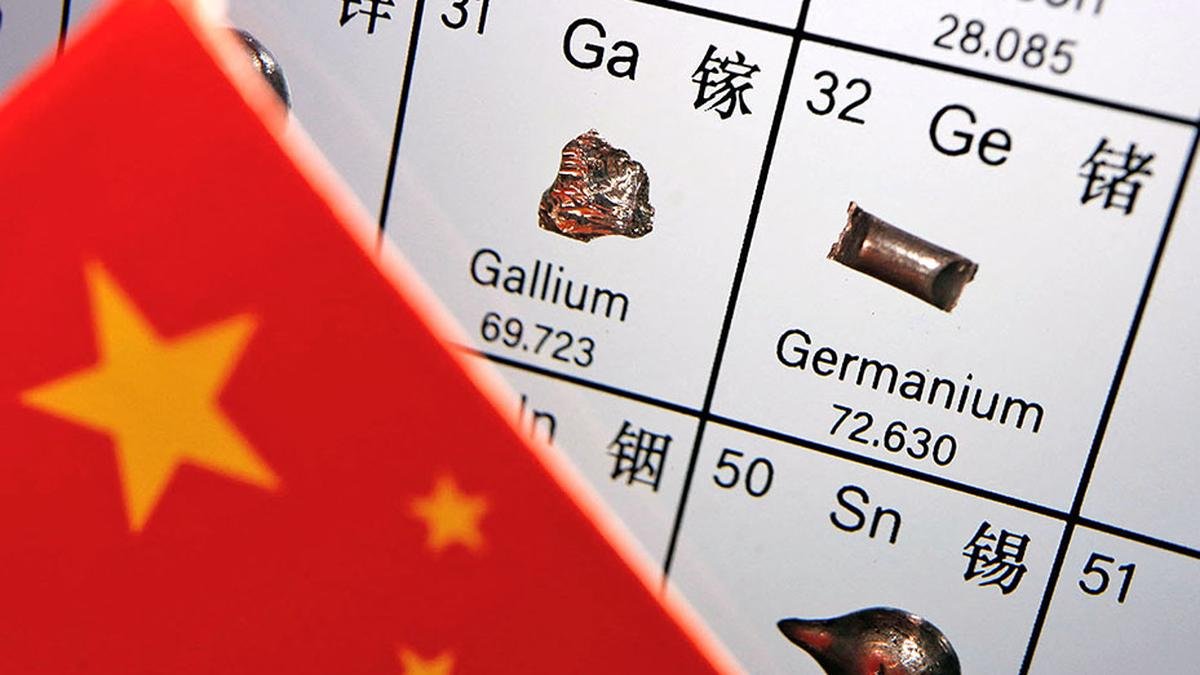

Context: On January 2, 2025, China’s Ministry of Commerce (MOFCOM) expanded its

export control list by including 28 entities from the United States,

effectively restricting their access to a swath of items classified under

dual-use export controls. Beijing’s list encompasses tungsten, gallium,

magnesium, beryllium, hafnium, lithium-6 (isotope), and others — minerals with

uses ranging from chip production to speciality alloys. India’s push for critical minerals development has

faced stubborn challenges. In 2023, lithium deposits that were found in Jammu

and Kashmir’s Reasi district made headlines, hinting at a game-changer moment

for India’s energy transition.

Key points

· Overview: The growing

geopolitical competition for critical minerals, a situation that directly

impacts countries like India, which remains heavily reliant on imports for

these essential materials. The situation underscores India’s need to strengthen

domestic mineral exploration and production capacities.

· China’s

Strategic Mineral Export Controls: Targeted Minerals -

China’s export control targets critical minerals such as tungsten, gallium,

lithium, and magnesium, vital for industries like semiconductors and batteries.

Weaponization of

Minerals - This is not the first instance of China using mineral exports as

leverage, seen previously in the 2010 rare earths embargo against Japan.

Strategic

Calculations - China balances its restrictions carefully, avoiding impacts on its own

industries and the global supply of minerals heavily reliant on Western

imports.

· India’s

Mineral Diplomacy and Exploration Efforts: Current Dependence -

India continues to rely heavily on imports for critical minerals, such as

lithium, cobalt, and rare earth elements, vital for its energy transition and

technology manufacturing.

Policy Initiatives

-

The Indian government has introduced reforms such as the Mines and Minerals

Amendment Act 2023 and set up KABIL to secure overseas mineral investments,

aiming to diversify supply sources.

Challenges in

Exploration - Despite these reforms, domestic exploration remains sluggish, with

insufficient foreign participation and challenges in the classification and

commercial viability of mineral blocks.

· India’s

Mineral Exploration and Market Participation: Outdated Classification

System - India’s outdated resource classification system leaves many

auctioned mineral blocks in early exploration stages, deterring investment.

Low Demand for

Exploration Licenses - Despite reforms, the demand for exploration

licenses remains low, reflecting the risk perception and lack of interest from

private and foreign investors.

Need for Fiscal

Incentives - Offering larger upfront fiscal incentives for exploration could mitigate

the risks, encouraging both domestic and foreign participation in mineral

extraction projects.

Comments (0)

Categories

Recent posts

Q5/ Section B, APSC Mains 2024 Essay - ...

29 Jul 2024

Satellite Town

21 Jul 2024

Q 1/Section A, APSC Mains 2024 Essay - ...

29 Jul 2024